Related News

Demi Penuhi Hak Rakyat, Menteri BUMN Minta BTN Tertibkan Developer Nakal Dalam Penyelesaian Sertifikat

21 Jan 2025

BTN MULAI AKUISISI BANK VICTORIA SYARIAH

20 Jan 2025

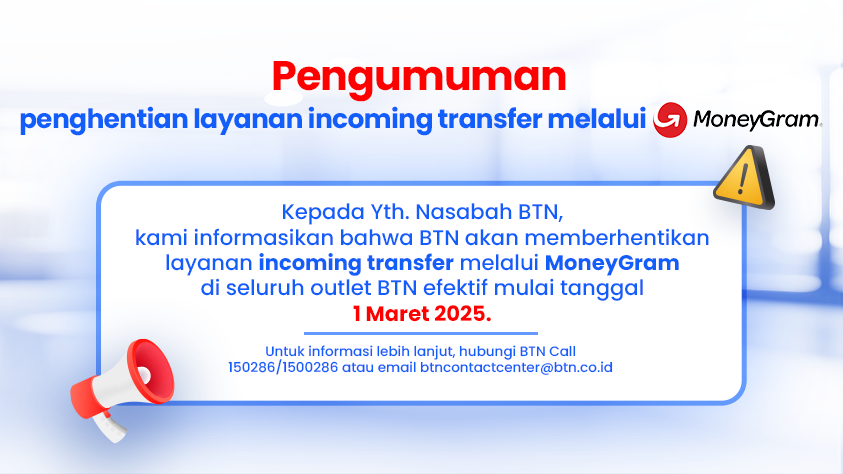

Pengumuman Penghentian Layanan Incoming Transfer melalui MoneyGram

15 Jan 2025

Pengumuman Batas Waktu Penggunaan Cek dan Bilyet Giro BTN dengan Logo Lama

14 Jan 2025