ESG Signatory

Our Commitment to Responsible Banking

BTN proudly stands as Indonesia's first state-owned bank to embrace the Principles for Responsible Banking. This milestone reflects our commitment to sustainability and leadership in driving meaningful change. By aligning our strategies and operations with global sustainability goals, BTN is shaping a future that's inclusive, equitable, and environmentally responsible. As a signatory, BTN is dedicated to delivering lasting impact through our products, services, and financing activities.

What is the UNEP FI Responsible Banking Signatory?

The United Nations Environment Programme Finance Initiative (UNEP FI) has developed the Principles for Responsible Banking as a framework to guide financial institutions in advancing a sustainable future. These principles empower banks to integrate sustainability into their business strategies, foster positive societal impact, and drive meaningful change within their communities and beyond

Principles for Responsible Banking ?

The following six principles help our industry make positive contributions

to people and our planet.

-

Alignment – We will align our business strategy to contribute to your needs and society’s goals.

-

Impact & Target Setting – We will increase our positive impacts while reducing the negative

-

Clients & Customers – We will encourage sustainable practices with our partners.

-

Stakeholders- We will engage and partner with relevant stakeholders to achieve society’s goals

-

Governance & Culture- We will implement our commitment to the Principles through effective governance

-

Transparency & Accountability- We will continuously review our progress and be accountable for our positive and negative impacts

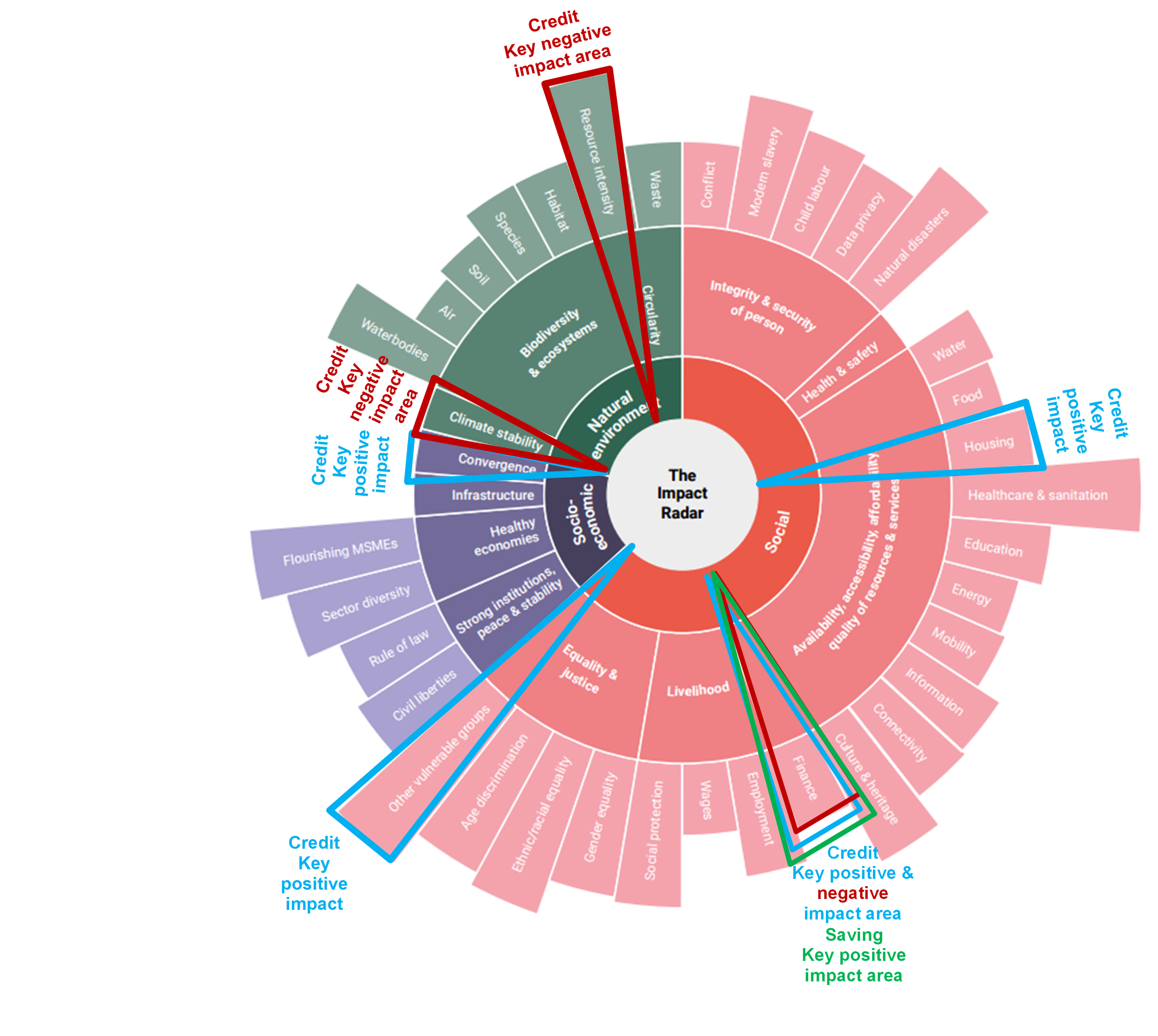

BTN Impact Radar

The Impact Radar shows BTN's key areas of positive and negative impact across environmental, social, and economic dimensions. It highlights where BTN's financing activities contribute to sustainability and where risks need to be managed. The radar helps guide BTN's efforts to maximize positive outcomes and minimize negative effects.

Download our responsible banking progress statement Here