ESG Framework

Building a Sustainable Future Towards a Green Economy

BTN focuses on ESG plans in the housing sector, to achieve long-term sustainability and responsible banking practices.

ESG Framework

Economic growth and business growth cannot be separated from social and environmental problems. To drive a national economy that prioritizes harmony between economic, social and environmental aspects, is able to maintain economic stability and is inclusive, adequate funding sources are needed.

The Bank understands that as an organization it has the opportunity to contribute to the future, including improvement or decline in economic, environmental and social conditions.

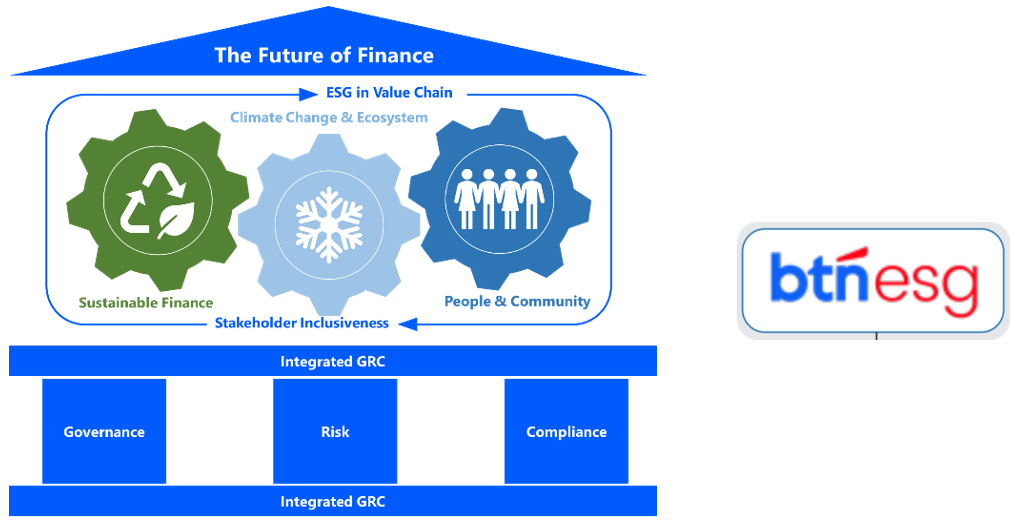

"The Future of Finance" is BTN's ESG Framework which is a set of principles that provide guidance for the Bank in managing and carrying out business practices that are oriented towards impact performance and supporting the achievement of sustainable development goals (SDG). This framework is the basis for managing business activities and operations as well as a more comprehensive decision-making process, including;

-

Management of products and services that support the transition process towards a low-carbon economy and maintain social balance in opening up equal access to capital (Sustainable Finance);

-

Management of climate change risks and their impact on ecosystem capacity (Climate Change and Ecosystems);

-

Management of impacts on humans and communities as well as wider society in general (People and Community);

The framework built is based on the awareness of the Bank and its stakeholders (Stakeholder Inclusiveness) throughout the Bank's value chain (ESG in the value chain), which forms an interdependent system where these relationships create risks and opportunities related to sustainability for the Bank that need to be managed in an integrated manner. to enable the Bank to achieve goals and overcome uncertainty with integrated GRC.

ESG Strategy

BTN's ESG Strategy is BTN's concrete step in implementing the ESG Framework by using 9 strategic steps which will be implemented inclusively.

- 1Carry out sustainable bank business operations

- 2Develop sustainable and inclusive bank products and portfolio management

- 3Integrate ESG components into enterprise risk management frameworks and programs

- 4Develop an ESG culture program and responsible leaders

- 5Building a control environment that is integrated with ESG components

- 6Develop ESG monitoring, communication and reporting programs

- 7Develop ESG monitoring, communication and reporting programs

- 8Navigate trends in ESG rules and regulations

- 9Building partnerships and cooperation

Roadmap ESG

Realize the Future of Finance through implementing a roadmap which is carried out in stages and on target by dividing it into 3 phases; namely Action, Advance, and Accelerate.

BTN Sustainable Development Goals (SDGs - 5P) Principles

Operasional dan aktifitas BTN mengadopsi kerangka Sustainable Development Goals (SDGs) yang berfokus pada 5P: People, Planet, Prosperity, Peace, dan Partnership. Langkah ini merupakan komitmen untuk mendukung pembangunan berkelanjutan yang meliputi:

-

1

People (Manusia)

Meningkatkan kesejahteraan masyarakat melalui berbagai produk dan layanan keuangan yang inklusif dengan mendukung program pemberdayaan manusia, komunitas, dan pendidikan.

-

2

Planet (Planet)

Berkomitmen pada prinsip green banking dengan memprioritaskan inisiatif ramah lingkungan dengan pembiayaan berkelanjutan.

-

3

Prosperity (Kemakmuran):

Berperan aktif dalam meningkatkan pertumbuhan ekonomi yang inklusif dan berkelanjutan melalui pembiayaan perumahan yang terjangkau.

-

4

Peace (Perdamaian):

Menerapkan dan mendukung tata kelola perusahaan yang baik (GCG) dan transparansi dalam setiap aspek operasional untuk menciptakan lingkungan bisnis yang adil dan harmonis.

-

5

Partnership (Kemitraan):

Berkolaborasi dengan berbagai pemangku kepentingan, termasuk pemerintah, sektor swasta, dan organisasi masyarakat, untuk mendukung pencapaian SDGs.

Our Contribution to Sustainable Investment

Discover BTN's steps and strategies to realize corporate social responsibility.

Environment

Social

Governance